Lifeway Foods: Why Danone’s Offer Falls Short

Looks like 2024 might be the perfect time for Danone to crack open the checkbook and slide some cash the Smolyansky family's way.

I first became aware of Lifeway Foods (NASDAQ: LWAY) in 2021, when its stock was trading at ~$6/share. At the time, I was intrigued by its position as the market leader in kefir in the United States and its exposure to the growing demand for functional foods. However, I eventually stopped following the company, thinking its story had no major surprises.

That changed last week when I came across the news that Danone, its second-largest shareholder, attempted to acquire LWAY. This news made me take a fresh look at the company, its fundamentals, and its future. In this post, I take a quick look at why Lifeway rejected Danone's offers, what its true intrinsic value might be, and how this story could play out.

Ezra.

Company Overview

Lifeway Foods, Inc. is a U.S.-based company that produces and markets kefir, a cultured dairy product that is rich in probiotics. Founded in 1986, Lifeway introduced kefir to the American market, initially targeting ethnic communities in the Chicago area. Over the years, the company has expanded its reach and grown into the largest producer of kefir in the United States. Its flagship product is drinkable kefir, a tangy and protein-rich dairy beverage that contains 12 live and active cultures, delivering billions of probiotics per serving.

In addition to kefir, Lifeway offers a variety of dairy products, including drinkable yogurt, European-style cheeses, and kid-friendly probiotic drinks under the ProBugs brand. The company operates several manufacturing facilities in the U.S., with most of its products being produced domestically. A small portion of its offerings is manufactured through co-packers in Ireland and California to serve European and other international markets.

The microcap distributes its products through retail chains, distributors, and a direct store delivery system. While the U.S. remains its primary market, the company also exports to regions like Mexico, South America, Europe, and the Middle East. Its marketing emphasizes the health benefits of probiotics and positions its products as nutritious, better-for-you food options.

Lifeway Foods operates in the thriving probiotics and functional foods industry, driven by increasing consumer focus on gut health and demand for nutritious, better-for-you products. Key tailwinds include the growing popularity of probiotics, a shift toward healthier eating habits, and the expansion of functional dairy markets globally. Kefir stands out with its high probiotics, protein, and calcium content, catering to health-conscious and wellness-focused consumers.

In fact, the company is the largest U.S. producer of kefir, offering a diverse product line and leveraging its established brand to lead in this niche.

The management team has skin in the game. The Smolyansky family has maintained ownership of Lifeway Foods since its inception. Michael Smolyansky founded the company in 1986. After his passing in 2002, his daughter, Julie Smolyansky, became CEO, and his son, Edward Smolyansky, took on the role of CFO. The family continues to hold a significant ownership stake, with Julie, Ludmila, and Edward Smolyansky collectively owning approximately 47% of the company's common stock.

Danone owns 23.4% of Lifeway Foods' outstanding stock, making it a major shareholder since 1999. Its ownership is governed by a Stockholders' Agreement, requiring Danone's consent for key corporate actions, which gives it significant influence over Lifeway’s decisions. Danone a history of acquiring full ownership of companies in which it has a minority stake when the timing is right.

Looks like 2024 might be the perfect time for Danone to crack open the checkbook and slide some cash the Smolyansky family's way.

Danone's offer and why LWAY rejected it

In September, Danone sent a takeover offer to LWAY for US$25/share to buy all the shares in the company.

In November, Danone sent a second offer for US$27/share, which represented a 72% premium over the average share price over the last 3 months.

Both offers were rejected by the LWAY board, which adopted a limited-duration shareholder rights plan to prevent Danone or any other entity from gaining control without offering an appropriate premium or giving the board sufficient time to act on shareholders' interests.

But why did they reject the offer?

The management itself gave the answer:

Lifeway has achieved 20 consecutive fiscal quarters of YoY topline growth.

Over the past 5-y, Lifeway achieved a TSR of 788% (as measured through September 23, 2024, the last full trading day before Danone's initial unsolicited proposal was publicly disclosed), far outperforming other high growth food and beverage peers as well as the S&P 500.

From 2019 to 2023, the Company's annual revenue has grown from US$94 million to US$160 million, a 71% increase and a 14% CAGR.

Over that same 5-y period, gross profit increased 92%, representing an 18% CAGR, with continued Operating Income and Adjusted EBITDA margin expansion over the same period achieving US$17 million in Operating Income and US$22 million in Adjusted EBITDA in 2023.

The Board and management believe that Lifeway has reached an inflection point, with strong momentum in core kefir products, new product adjacencies and ongoing operational efficiency programs, which have rapidly improved profitability and which the Company expects to continue to rapidly improve profitability

Lifeway forecasts annual Adjusted EBITDA to grow from US$22 million in 2023 to between US$45 million and US$50 million in 2027.

Based on the expected 2027 EBITDA range, the Danone proposal of US$27 per share implies a very low multiple of ~7.5x – 8.5x EBITDA, even prior to accounting for substantial synergies and additional operational efficiencies that Danone (or another strategic acquirer) could realize.

LWAY back-of-the-envelope valuation

I made a back-of-the-envelope valuation considering 3 scenarios. In each scenario, I take into account the following and being a little bit conservative in my numbers:

The 2027E EBITDA mentioned by management of US$45-50 million.

Current Outstanding Shares of 14.82 million

Current stock price (11/29/2024): US$24.25/share

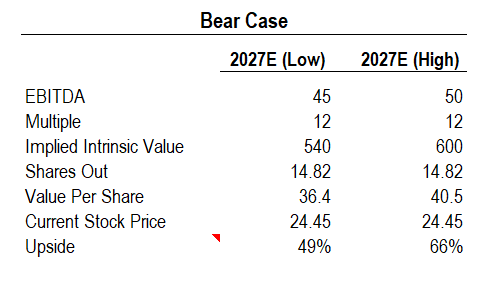

Bear Case

Here I take into account a multiple of 12x EBITDA, which is approximately what LWAY has been trading at in the last 5y. This would take LWAY to:

Implied 2027E EBITDA: Between US$540 — 600 million

Intrinsic value/Share: US$36.4 — 40.5

Upside: 49-66%

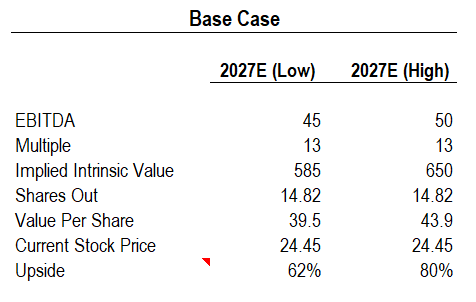

Base Case

13x EBITDA (5y. average Daily industry EBITDA multiple)

Implied 2027E EBITDA: Between US$585 — 650 million

Intrinsic value/Share: US$39.5 — 43.9

Upside: 62-80%

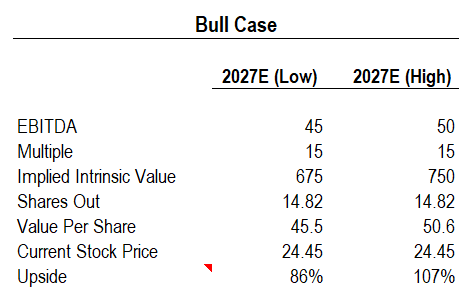

Bull Case

+15x EBITDA (taking into account synergies and the growth that Danone can provide to LWAY)

Implied 2027E EBITDA: Between US$675 — 750 million

Intrinsic value/Share: US$45.5 — 50.6

Upside: 86-107%

My Two Cents

Danone's offer of 7.5x EBITDA is frankly insufficient, considering Lifeway's historical growth and leadership in an industry with strong tailwinds.

Taking into account the growth of this microcap that is a leader in its market in an industry with a lot of growth and future, if I were the majority shareholder I would ask for at least +13x EBITDA, justifying the potential of Lifeway Foods under Danone's umbrella, taking advantage of its size to grow faster and enter with more presence in the overseas markets where LWAY already operates.

I think Lifeway's negotiating position is solid, but the outcome will depend on the strategic vision of its majority shareholders who prefer the company to be sold arguing that "Julie is prioritizing family legacy over shareholder interests."

Do you think Danone will end up paying the fair price?

Also, if you enjoyed this post, please share it and my newsletter with your friends and colleagues!