Notes of Ingles Markets Write-Up by Gwen Hofmeyr

My notes on Gwen's Hofmeyr Ingles Markets Write-Up. The company is substantially undervalued, with a real estate portfolio alone worth more than its current market cap.

Hey, guys!

Last weekend I had the chance to read Gwen’s write-up on Ingles Market. I came across her write-up a few months ago, but finally, I had the opportunity to take a look.

I first met Gwen on LinkedIn (and she happens to be a member of MOI Global as well) when she posted her Ingles write-up and it was a hit on the social network. Several investors shared their comments about Gwen's great work.

I agree: Gwen has done a great job and the quality of her write-up is of the highest quality; going beyond the company filings and searching the public records to discover the true value of Ingles Markets.

Without further ado, I am sharing my notes on Gwen's write-up, with her permission, and at the end of the post, I have attached the complete write-up in PDF format.

P.S. If you want to know more about Gwen's work and career, you can follow her on LinkedIn (an interview with her on MOI Global is coming soon).

And if you are looking for a valuable analyst for your investment team, Gwen is the choice.

Ezra.

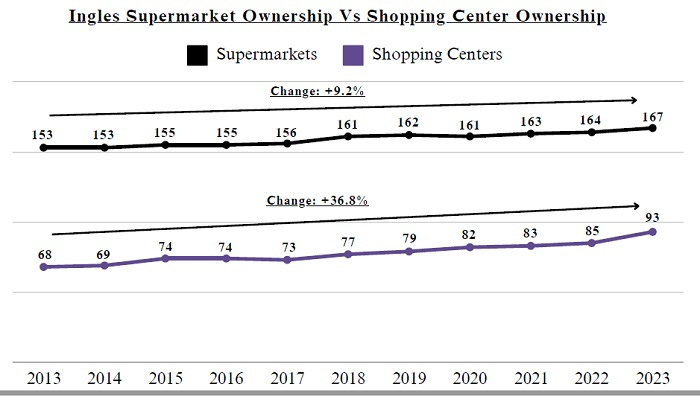

Company Overview

Ingles Markets, Inc. (NASDAQ: IMKTA) is a family-owned regional supermarket chain headquartered in Asheville, North Carolina. Founded in 1963 by Robert P. Ingle, the company operates 198 supermarkets and 93 shopping centers across six Southeastern U.S. states: North Carolina, South Carolina, Georgia, Tennessee, Alabama, and Virginia. The company's supermarkets operate under the "Ingles" and "Sav-Mor" brands, and it offers additional services like fuel stations, pharmacies, Starbucks kiosks, and curbside pickup.

Ingles is highly vertically integrated, with 1.65 million square feet of distribution and warehouse space and a fleet of tractors and trailers to manage its logistics. Through its subsidiary Milkco, Ingles also manufactures a significant portion of the dairy products sold in its stores. Furthermore, Ingles Leasing handles the company's shopping center properties, leasing out spaces to third-party retailers. This diverse business structure enables Ingles to maintain tight control over its supply chain and operations.

Undervalued Real Estate Portfolio

Ingles Markets owns significantly more land than disclosed in financial reports, including 3,700 acres compared to the reported 160 acres.

The estimated fair market value of Ingles' real estate portfolio is US$1.39 billion, which includes US$657.7 million in off-balance-sheet value. This suggests a substantial hidden value that is not fully reflected in the company’s financials.

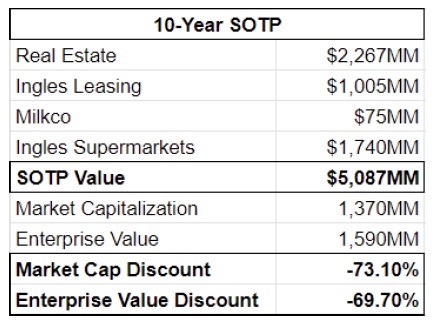

Gwen projects that by 2033, the real estate portfolio could grow to US$2.27 billion through appreciation and continued acquisitions.

Business Segments

Ingles Supermarkets

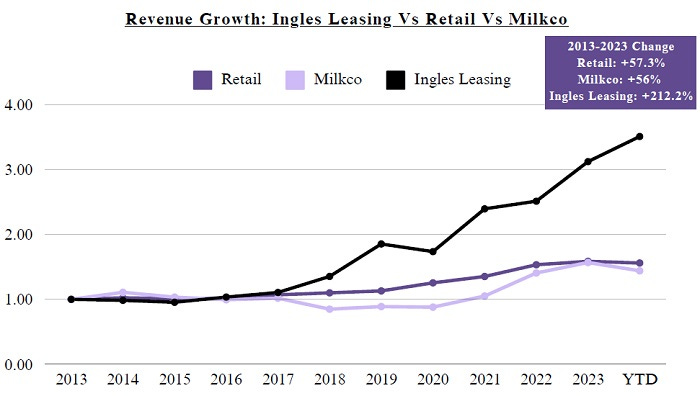

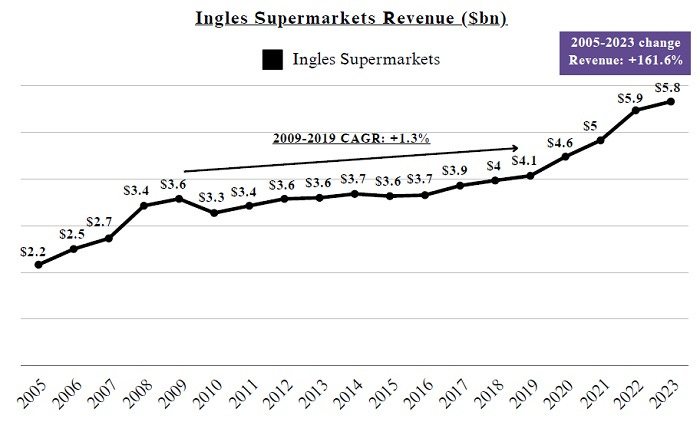

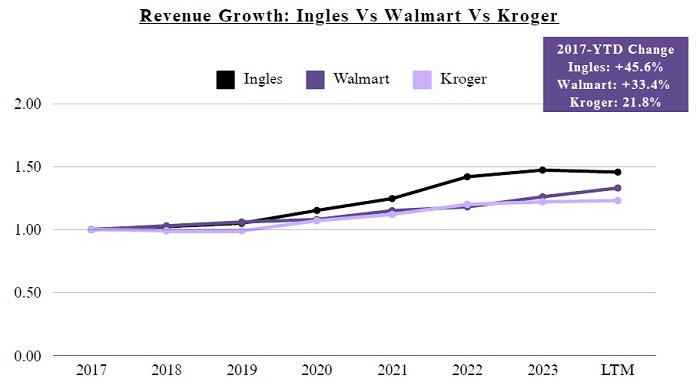

Ingles generated US$5.9 billion in revenue in 2023, a 161.6% increase from 2005 to 2023.

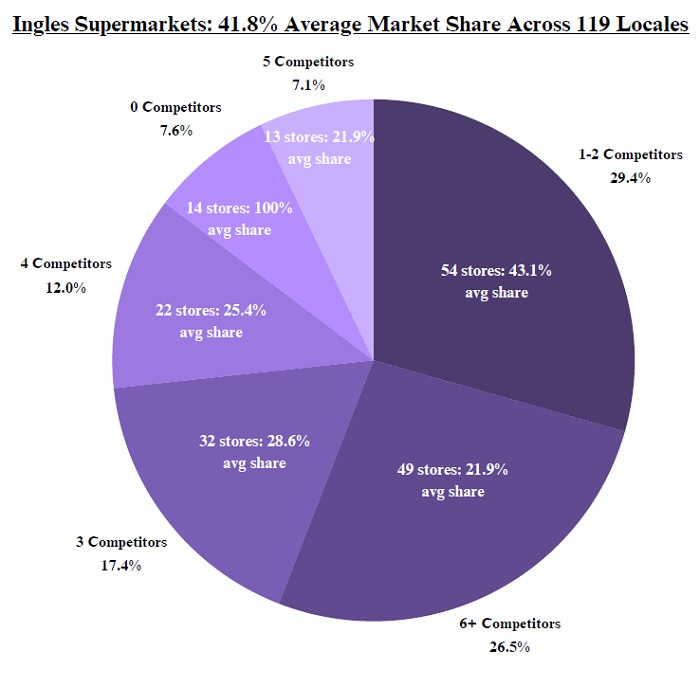

The company has an average 41.8% market share across 119 local markets, remaining competitive against major chains like Walmart and Publix.

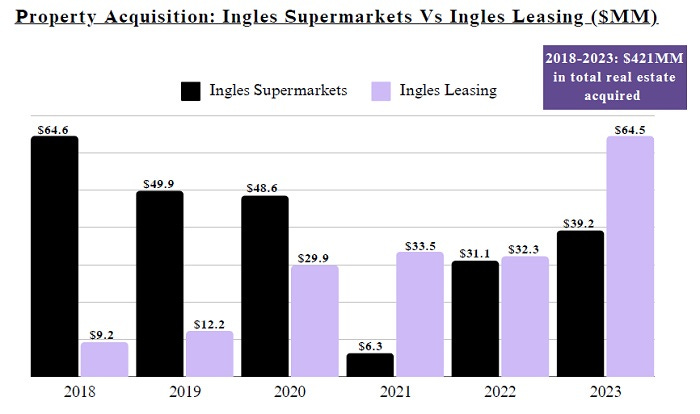

Since 2014, an average 19.3% of annual EBITDA has been allocated to real estate acquisitions, but closer analysis reveals marked shifts in that allocation. From 2013 to 2017, total supermarkets owned increased by 2%, while owned shopping centers increased by 7.4%. In 2018, management accelerated their real estate acquisition strategy, but shifted the bulk of capital allocated to shopping center acquisition. Hence, from 2018 to 2013, Ingles’ shopping center ownership increased 27.4%, compared to just 7.1% for supermarket ownership.

Milkco (Dairy Division)

Milkco provides 72% of the dairy products sold in Ingles supermarkets and also sells to third-party retailers.

Milkco has a strong EBIT margin of 7.6%, contributing to the overall profitability of Ingles.

Ingles Leasing

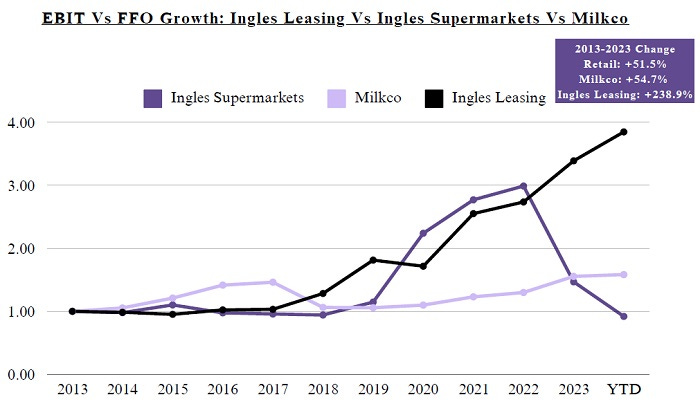

Ingles Leasing, which handles the company’s shopping center properties, is a key driver of growth. It generated US$21.5 million in FFO (Funds from Operations) in 2023.

The division has an FFO margin of 86% and has grown at an annual rate of 14.7% between 2014 and 2023.

The impact of management’s decision to focus on the expansion of Ingles Leasing is significant. Not only does shopping center ownership reduce retail space availability for competitors, but the property leasing industry is substantially more profitable than the supermarket industry. Consequently, the rise of Ingles Leasing likely to result in company-wide margin improvement over time.

One critique of measuring FFO as a percentage of EBIT may be that it unfairly exaggerates the impact Ingles Leasing has on pre-tax margins in the absence of like add-backs for the depreciation of owned real estate by Ingles Supermarkets. To get a like-comparison, the addition of depreciation, less capex unrelated to changes in land and buildings needs to be calculated. For the purposes of this report, the aforementioned adjustments are calculated as change in land and buildings, minus: change in leasehold improvements, change in construction in progress, change in transportation equipment, and change in store, office, and warehouse equipment.

Competitive Landscape

Ingles competes with large national chains like Kroger, Trader Joe’s, Aldi, and Walmart but maintains an impressive market share. Across the 119 markets analyzed, Ingles holds a 41.8% market share, while Walmart averages 26.1% and Publix averages 21.1%.

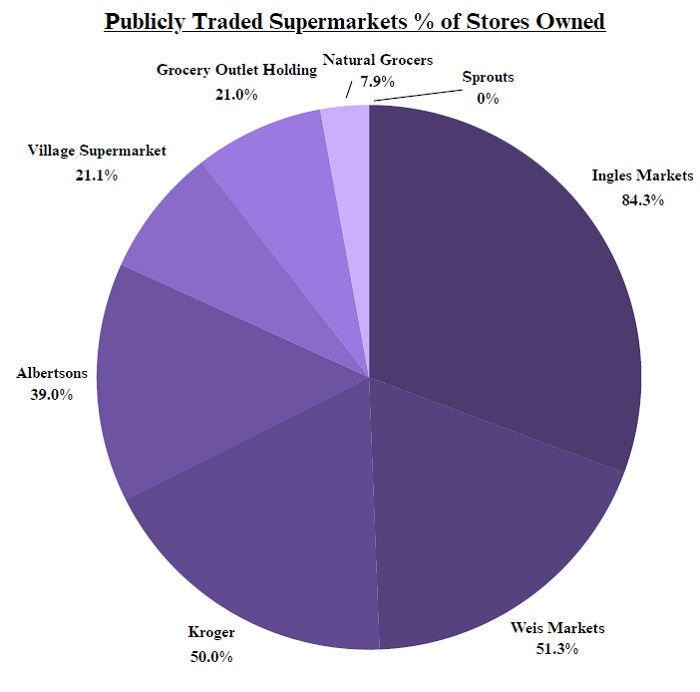

The company owns 84.3% of its supermarkets, making it one of the highest store ownership rates among publicly traded U.S. supermarkets. This ownership of both stores and land restricts competition from entering their markets.

Inflation-Resistant Business Model

Ingles has demonstrated strong resilience against inflation, with net profit margins expanding from 2.9% in 2020 to 5.0% in 2022—a 163.2% increase.

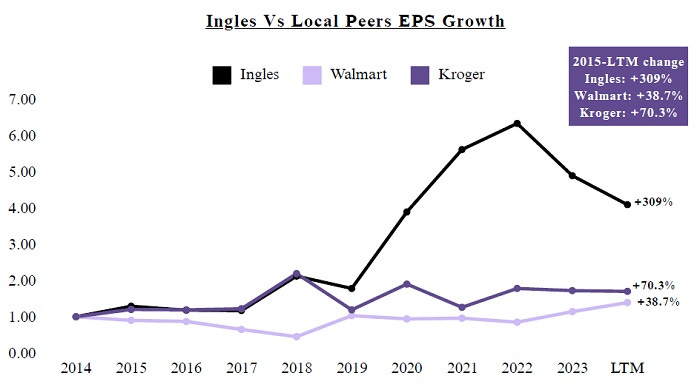

During this same period, Ingles’ EPS grew by 309%, compared to Walmart’s 38.7% and Kroger’s 70.3%, highlighting the company’s ability to manage costs and drive earnings growth despite rising prices.

Management

The company is led by Bobby P. Ingle, who holds 22% of shares outstanding and has repurchased 20.4% of shares over the past decade.

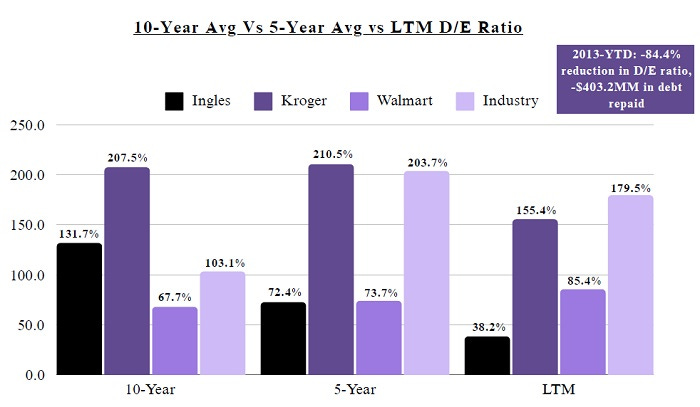

Ingles has also reduced its debt by US$403 million, improving its debt-to-equity (D/E) ratio to 38.2%, down from 131.7% ten years ago, giving it a stronger balance sheet than its competitors

Valuation

Ingles is currently trading at a P/TB ratio of 0.87x, which is 52.3% lower than its historical average of 1.28x.

When accounting for the US$657.7 million in off-balance-sheet real estate, the P/TB ratio adjusts down to 0.61x, indicating that the company is highly undervalued.

Ingles’ current market capitalization is US$1.4 billion (As of the date of the write-up), while the total asset value, including its real estate and supermarket operations, is estimated at US$5.1 billion, suggesting that the company is trading at only 31% of its projected 10-year value.

Related Party Transactions

Gwen mentions that related party transactions have been a point of concern for investors, given their volume and nature. Specifically, in 2023, Ingles engaged in several notable transactions with entities related to its chairman, Bobby Ingle. These included:

Loans amounting to US$330,000 issued to insiders in 2023 (there were no loans in the prior year).

Two properties, with a combined fair market value of US$5.8 million, were sold to Ingles by an LLC in which Bobby is a principal.

An additional property owned by Bobby’s LLC was traded for a similar property owned by Ingles.

She clarifies that these types of transactions are unusual compared to past activities. Between 2012 and 2023, around US$13.3 million in assets have been exchanged between Ingles and Bobby’s LLC. The most notable historical transaction was a US$2.5 million sale of Bobby’s private plane to Ingles in 2012.

While such related party transactions are always worth investor scrutiny, Gwen suggests that they do not pose a material risk to the company’s overall financial health, as Ingles has generated US$2.2 billion in acquisition-adjusted FCF since 2014, making these transactions inconsequential relative to its overall wealth. Furthermore, these deals are not significant enough to suggest any concerted effort by management to defraud shareholders.

Conclusion

Gwen Hofmeyr concludes that Ingles Markets is substantially undervalued, with a real estate portfolio alone worth more than its current market cap. The company’s inflation-resistant supermarket business, rapidly growing leasing division, and strong financial management make it a compelling investment.

Here’s Gwen’s full write-up in case you wanna take a look a it.

What do you think about Gwen’s write up?

Also, if you enjoyed this post, please share it and my newsletter with your friends and colleagues!